EXIT Realty Premier Blog

Is a 20% Down Payment Really Necessary To Purchase a Home?

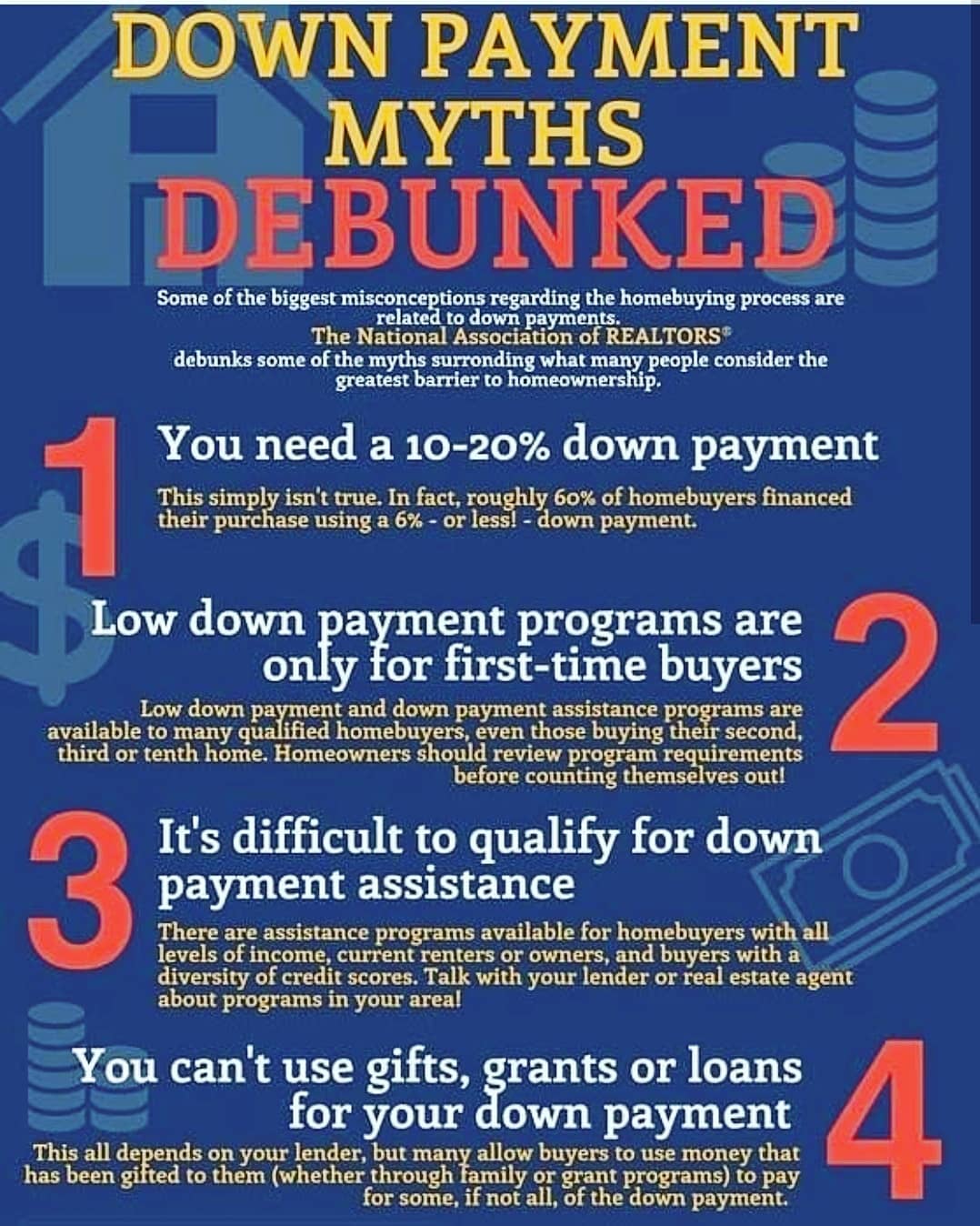

There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from purchasing a home. For over half of those surveyed, the ability to afford a down payment is the biggest hurdle.

That may be because those individuals assume a 20% down payment is necessary. While putting more money down if you’re...

Home Price Appreciation Forecast

Questions continue to come up about where home prices will head throughout the rest of this year, as well as where they may be going over the few years beyond.

We’ve gathered current data from the industry’s most reliable sources to help answer these questions:

The Home Price Expectation Survey – A survey of over 100 market analysts, real estate experts, and economists conducted by Pulsenomics each quarter.

Mortgage Bankers Association (MBA) – As the lead...

Have questions about the home buying or selling process? Is it right for you? Is it financially viable? Contact us now for a free, no obligation session with a Premier agent. 516 795 1000

Exit Realty Premier: Your Massapequa and Long Island Real Estate Partner

Study after study shows that no matter what generation Americans belong to, the vast majority believe that homeownership is an important part of their American Dream. The benefits of homeownership can be broken into two main categories: financial and non-financial (often referred to as emotional or social reasons.)

For Americans approaching retirement age, one of the greatest benefits to homeownership is the added net worth they have been able to achieve simply by paying their mort...

Whose Mortgage Do You Want to Pay? Yours or Your Landlord’s?

There are some people who haven’t purchased homes because they are uncomfortable taking on the obligation of a mortgage. However, everyone should realize that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temp...

Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.”

Myth #1: “I Need a 20% Down Payment”

Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down payment required.

Many...

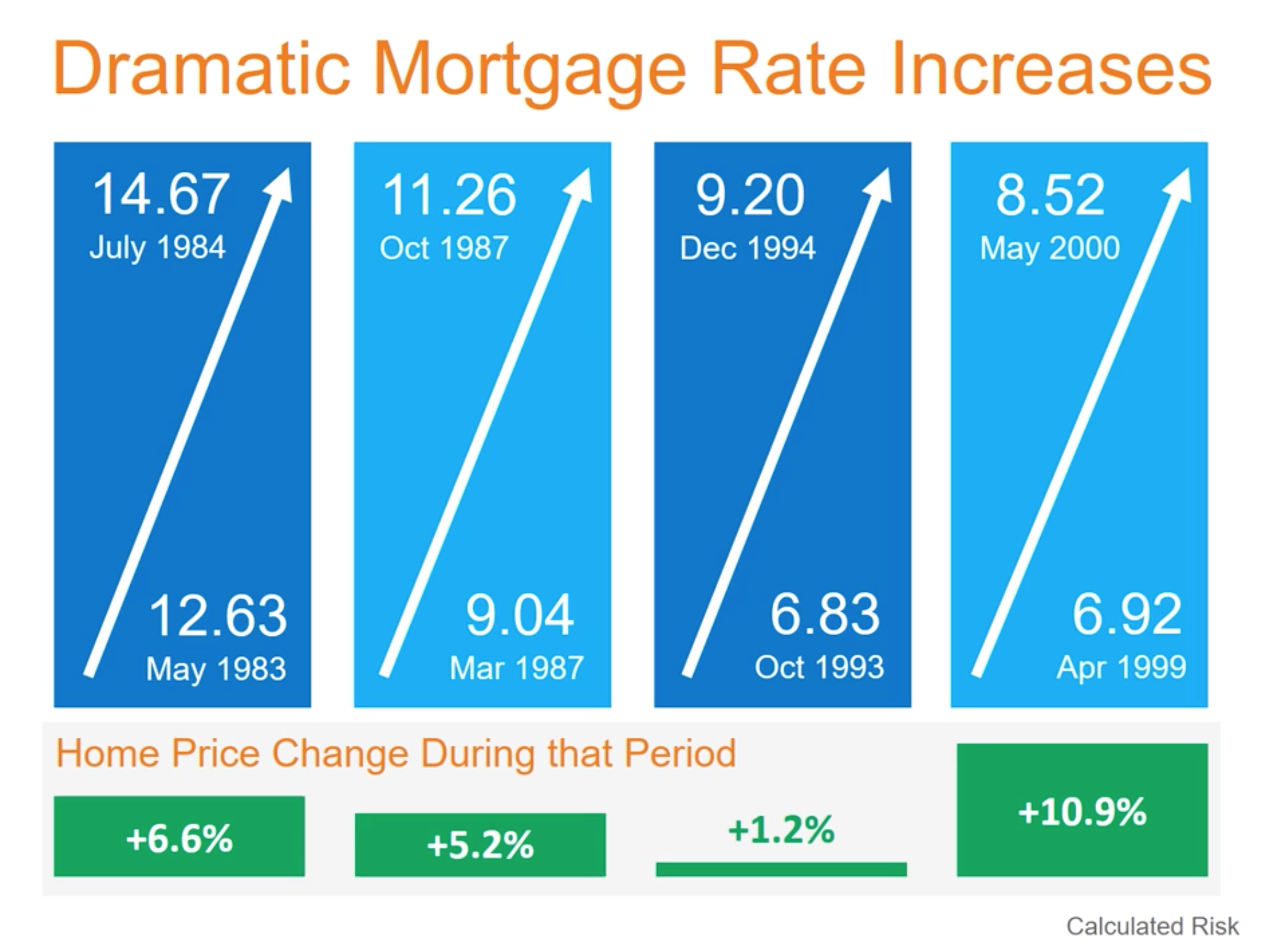

We know that the rates have been at an all-time low over the summer with people buying homes with a 3.39 interest rate on their mortgage. People who were planning to buy in the summer but hesitated are now kicking themselves in the rear end for not being more decisive. The 30 year fixed rate has gone up to 4.13% as of December 12th, 2016. Now this might seem like the end of the world to some folks but this hike shows confidence in real estate and shows the strength of the pool of buyers and...